What is the Value Investing? Definition!

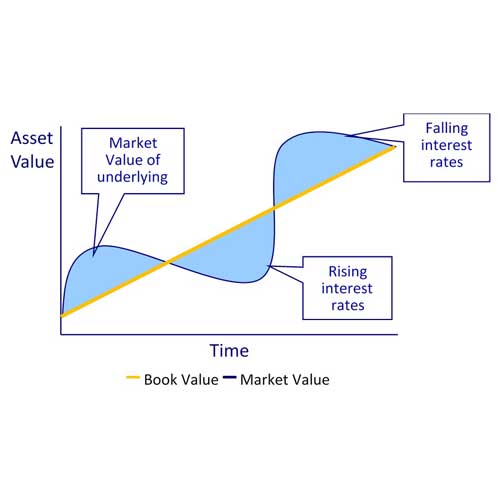

In financial terms, value investing is a strategy to searching, locating and picking those stocks that are found to be trading / selling in the stock market for less than their fundamental or book value and then invest in them. The investors, investing in these stocks, are called Value investors. Such investors of stock market actively remain in search of such stocks, about which they think; the stock market underestimating.

1. Example of Value Investment

When financial markets fell to great extent but value investors remain hopeful that in near future, it would arise again or at least will remain unstable or volatile for a time to come. In such situation, the value investor would purchase the stocks at a low value, holding them till the market is restored and secured stability. Then the stocks can be sold at a higher rate than when it was bought.

2. Warren Buffett Value Investing Theory

The investment strategy, developed by Howard Warren Buffett, CEO and Chairman of Berkshire and Hathaway, has remained reliable and consistent over a long tenure of decades. It is based on the principle of value investing, i.e. finding those companies, stock of which has been selling below their hidden and intrinsic value but they have a strong but hidden financial potential for financial growth and high return in the long term to come.

3. Value Investor Model of Warren Buffett

Committed believers in the Warren Buffett value investment model of stock market have strong belief that investors should buy stocks of only those companies with strong and solid financial fundamental footings, strong earning power and still with great potential for financial growth for future earnings.

Despite the many flaws in the strategy, Value Investing has strong followings who work on it and earn a lot.

4. Benefits of Value Investing

Value Investing is not an assured guarantee to earn rich returns. Regardless of your current financial income, experience in financial industry or your educational background in finance, you may become a successful value investor, provided:

- You are successful to compound accurately …

- You are on a best and reliable path to earn stock market profits …

- You are not taking too much risk …

- And stock is less risky and less volatile.

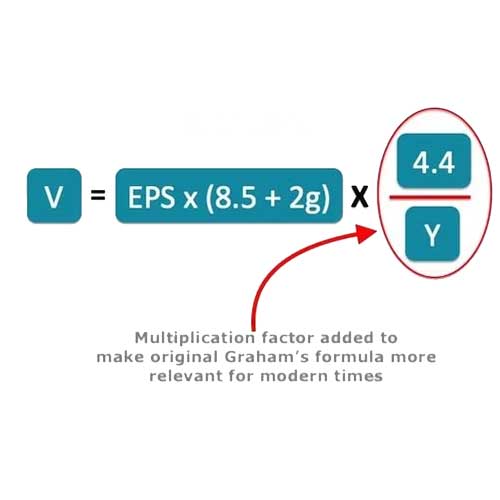

5. Most Common Graham Formula to Calculate Value Investing

The most popular and widely applied formula to calculate a stock is to search, investigate, analyze and then calculate the price-to-earnings (P/E) ratio of the company. The P/E ratio of the company equals the stock price of the company, divided by the most recent reported earnings per share (EPS) of the company. A low P/E ratio indicates that the investor buying the stock is making the right decision and expects to receive an attractive amount of value, whenever the stock is sold in the future.

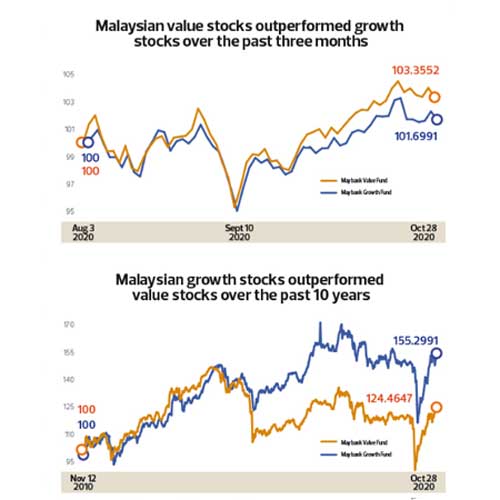

6. Difference Between Stock Growth and Value Investing

The term, Growth Stocks is applied to stock of those companies which are expected and considered by the stock market gurus to have the hidden potential to outdo and excel the overall stock market over the coming time. This high return may be due to the extra financial strength and earning of the company which the company may perform in future.

On the other hand, value stocks are classified to represent those companies that are at present trading in the stock market but below their actual and real worth but the stock of these companies are expected to gain excellent, rich and handsome return in future.

4 Simple Strategies of Renowned Value Investors

- The best strategy for Value Investors is to buy Whole Businesses, Not Simply Stocks.

- Keep, develop, retain, and rather; Love the Business, You have Acquired.

- Invest in Those Companies Only, Which You Think, are Financially Better.

- Try to Find Those Companies That Are Being Managed Well by Their Current Owners.